|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

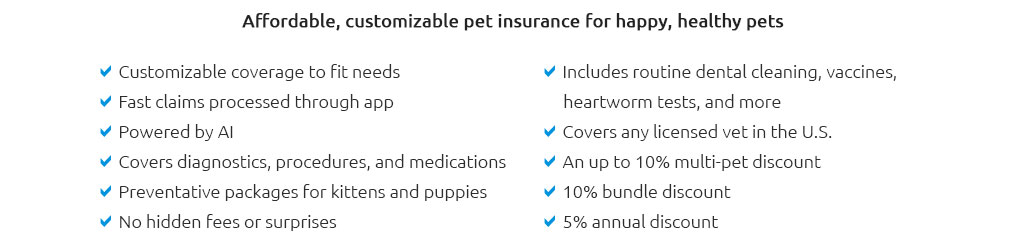

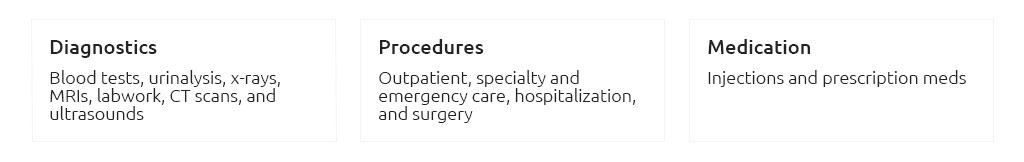

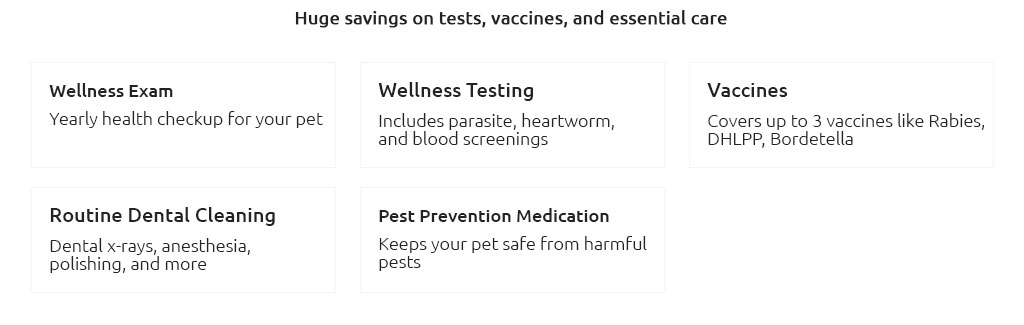

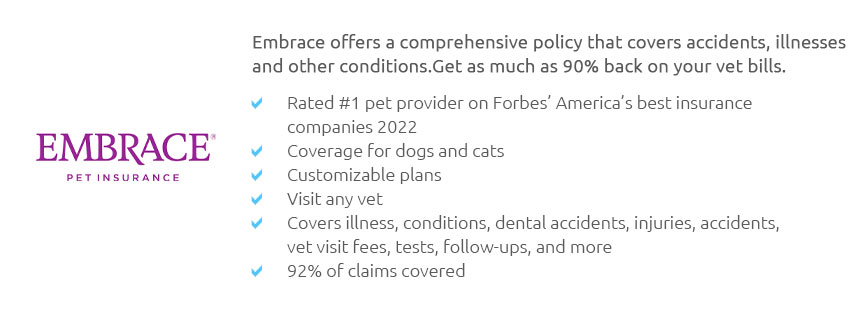

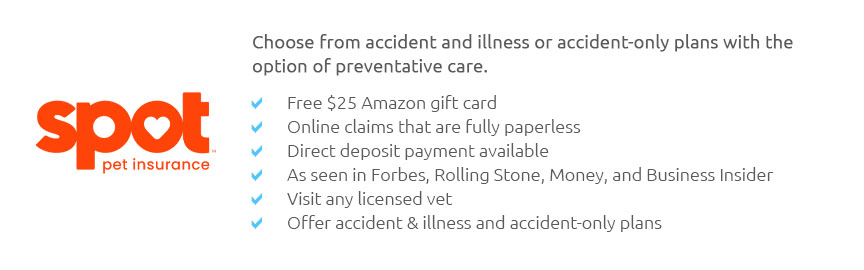

Top Ten Pet Insurance Plans for Comprehensive CoverageChoosing the right pet insurance can be daunting given the myriad of options available. This guide breaks down the top ten pet insurance plans, offering insight into their features and benefits. Understanding Pet InsurancePet insurance is a crucial consideration for pet owners aiming to safeguard their furry friends against unexpected medical expenses. Let's delve into the components that make a pet insurance plan worth considering. Top Ten Pet Insurance Plans1. Healthy Paws Pet InsuranceHealthy Paws is renowned for its comprehensive coverage and unlimited lifetime benefits. It offers a simple plan structure, making it easy for pet owners to navigate. 2. TrupanionTrupanion stands out with its direct payment option to vets, eliminating the reimbursement process. They cover hereditary conditions without any payout limits. 3. Embrace Pet InsuranceEmbrace offers customizable plans with a diminishing deductible, rewarding policyholders who do not file claims. 4. Nationwide Pet InsuranceNationwide provides a wide range of coverage, including wellness plans, making it ideal for those seeking cheap pet insurance with wellness benefits. 5. PetplanPetplan is known for its quick claim processing and comprehensive coverage, including alternative therapies and dental treatments. 6. ASPCA Pet Health InsuranceOffering flexibility in coverage levels and pricing, ASPCA is a solid choice for budget-conscious pet owners. 7. Figo Pet InsuranceFigo offers a cloud-based app for managing claims and a 24/7 veterinary helpline, ensuring pet owners are always connected. 8. Prudent Pet InsurancePrudent Pet provides extensive coverage options and a straightforward claims process, making it a user-friendly option. 9. Lemonade Pet InsuranceWith its AI-powered claims processing, Lemonade offers one of the fastest reimbursement times in the industry. 10. Pets Best Pet InsurancePets Best offers various plans that allow pet owners to choose the best fit for their needs, with options for routine care coverage. Factors to Consider When Choosing Pet Insurance

For a detailed comparison, you might want to compare pet insurance costs across different providers. FAQ

https://www.reddit.com/r/petinsurancereviews/comments/1c0bno9/best_pet_insurance_for_dogs_cats_according_to/

Pets Best is my top recommendation for similar reasons above. Additional, Pets Best has detailed dental coverage which can be an issue for many ... https://www.consumerreports.org/money/pet-insurance/is-pet-insurance-worth-it-a8622180631/

At Consumer Reports, we rated eight pet insurance providers: ASPCA, Banfield, Embrace, Fetch, Healthy Paws, Nationwide Pet Insurance, Pets Best, ... https://www.nerdwallet.com/p/best/insurance/pet-insurance-companies

MetLife, Embrace and Pets Best top our list of the best pet insurance companies. See which one is right for you.

|